Calculate payroll taxes 2023

TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate. The amount of payroll expense dollar thresholds SMC 538030 The amount of the exemption SMC 538040A1 The amounts calculated shall be rounded to the nearest whole dollar.

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

IRS Form 941 Employers Quarterly Tax Return is used to report employment taxes.

. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. 075 for 2023 085 for 2024 and 090 for 2025.

Payroll confidence starts here. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Ohio local counties cities and special taxation districts. If you decided to take advantage of the payroll tax deferral you must report this deferral on your tax return.

Depending on company personnel policies employees may be able to choose benefits that actually result in tax savings. Calculate your unemployment taxes. Employers who own and operate a business with employees need to file IRS Form 941 quarterly and are responsible for withholding federal income tax social security tax and Medicare tax from each employees salary.

The following timetable will help you keep track of the important tax deadlines for submitting forms for the 2022 tax year. The payroll tax rate reverted to 545 on 1 July 2022. Projected revenue from payroll taxes and income taxes on OASDI benefits credited to the HI Trust Fund increases from 15 percent of GDP in 2022 to 18 percent in 2096 under current law.

Easily check and view any historical pay runs and access payslips online for individual employees as needed. Useful for filing a no-payroll report or tax and wages for a small number of employees. 2022 unemployment tax rate calculator xls 2022 unemployment tax rate table.

What You Need to Know and Looking Ahead to 2023 11 min read. The current calculator is not set for a leap year. The expenses you pay with an EIDL advance are also fully tax deductible for federal taxes.

Learn about employment payroll and immigration for Belgium to help your company with local legislation. Total revenue is expected to be between 1080 million and 1086 million representing 26 year-over-year growth at the midpoint 30 year-over-year. If your agency processes payroll on the States semi-monthly basis you will have 26 payroll cycles in Fiscal Year 2023 July 1 2022 June 30 2023 bi-weekly payroll 24.

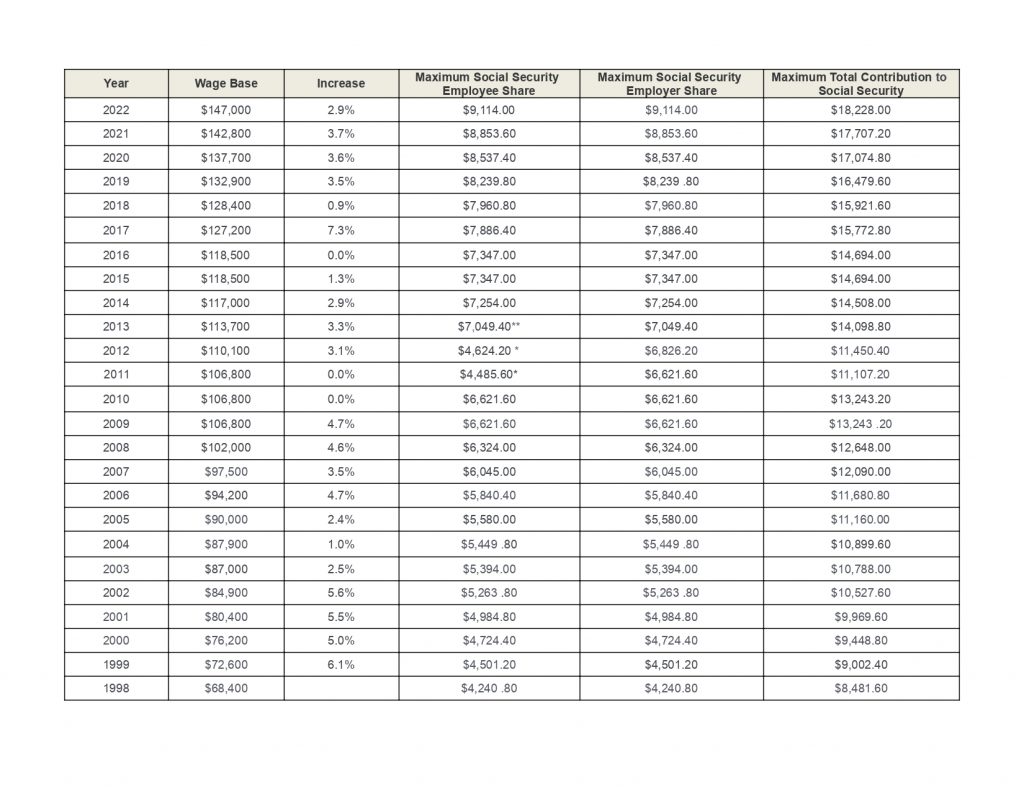

What is Form 941. 1 day agoSocial Securitys payroll tax works out to 124 for the self-employed. Other payroll deductions that may come into play.

Payroll Preparation Tax. Employees who wish more information on state and local taxes withheld should consult a tax professional or their companys payroll department. Payroll taxes are rarely a targeted form of tax relief although it has happened in the past before the CARES Act went into effect.

Paycheck Protection Program PPP The Paycheck Protection Program offers loans to small businesses to keep employees on payroll and cover certain other expenses during the coronavirus pandemic. During the same period however projected general revenue transfers to the SMI Trust Fund increase more rapidly from 17 percent of GDP in 2022 to 31 percent. In all other years the flat social tax is capped at 122.

From 1st June 2021 to 30th May 2023. Paying taxes as a household employer requires you to fill out and file Schedule H along with your federal income tax return and pay the tax amount due by April 18 2023. Purely Public Charitable Organizations shall calculate the tax that would otherwise be attributable to the municipality and file a return but shall only pay the tax on the portion of its payroll attributable to business activity for which a tax may be imposed pursuant to Section 511 of the Internal Revenue Code.

Companies who pay employees in Washington State must file for a business license in WA and register online. To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. They will then receive a number of ID and account numbers from the WA Department of Labor and Industries and Department of Employment Security.

It had originally closed applications on August 8 2020 but. Can be tough especially when youre trying to grow it at the same time. Please fill out the form to receive a free copy of our Portugal payroll taxes and benefits guide.

Living away from home allowance. Should I expectask for the holiday payment 13th salary instalment be made in my first month of. An EA has knowledge in tax-related subjectssuch as income estate gift payroll and retirement taxes.

For fiscal 2023 ending April 30 2023. How to calculate the total cost of import in Indonesia. Manage payroll for up to 100 employees get all the same features in each payroll tier.

When you enroll in the FSA you elect the amount you want withheld from each paycheck up to the maximum amount per pay period for each of the Health Care FSA and Daycare FSA. Different rates apply for truck drivers read Revenue Ruling PTA 024v2. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Please fill out the form to receive a free copy of our Belgium payroll taxes and benefits guide. Well handle the calculations automatically. This form is also used to calculate the employers portion of.

Economists have focused on some of the problems. Enter your bi-weekly gross to calculate your annual salary. Payroll tax relief before the CARES Act.

If the allowance does not qualify as a LAFHA under the FBT Act it will be treated the. The value if LAFHA for payroll tax purposes is the value determined in line with the Fringe Benefit Tax Assessment Act. For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022.

Process your teams payroll in 3 simple steps. Learn about employment payroll and immigration for Portugal to help your company with local legislation. Do we know when the 20222023 mandatory annual salary increases will need to be applied please.

They are licensed by the federal government. Meanwhile if you work for a business or someone else you and your employer split the payroll tax down the middle 62. This can be completed on Schedule SE and Schedule 3.

Living away from home allowances LAFHA are fringe benefit. Fiscal Year 2023 beginning July 1 2022 is not a leap year. The Inflation Reduction Act attempts to raise hundreds of billions of dollars from corporations without raising the corporate tax rate through a 15 percent book minimum tax a new alternative minimum tax applied to the financial statement income ie book income that companies report to their investors.

2

2022 Federal State Payroll Tax Rates For Employers

Social Security What Is The Wage Base For 2023 Gobankingrates

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

What S In Your Pantry Pantry Inventory Printable Checklist Pantry Inventory Pantry Inventory Printable Pantry Inventory Sheet

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Business Operating Budget Template Operating Budget Template Operating Budget Template What To Know About I Budget Template Free Budget Template Budgeting

2022 Federal State Payroll Tax Rates For Employers

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Pay Payroll Taxes A Step By Step Guide

How To Pay Payroll Taxes A Step By Step Guide

2022 Federal Payroll Tax Rates Abacus Payroll

When Are Federal Payroll Taxes Due Deadlines Form Types More

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Page Not Found Isle Of Man Isle Quiet Beach

Pack Of 28 Pay Salary Slips Templates Free Daily Life Docs Payroll Template Word Template Words